Alright folks, let’s dive straight into the deep end of the pool. The PPP loan warrant list is a topic that’s got everyone buzzing, whether you’re a small business owner or just trying to wrap your head around how government aid works during tough times. If you’ve been scratching your head wondering what this list is all about, you’re in the right place. This article is your ultimate guide to understanding everything—from A to Z—about the PPP loan warrant list. So grab your favorite drink, sit back, and let’s break it down together.

Now, before we get too far, let’s clear the air. The Paycheck Protection Program (PPP) was a game-changer for businesses affected by the pandemic. But as with any big government program, there are always strings attached. One of those strings? The PPP loan warrant list. This isn’t just some random spreadsheet floating around—it’s a critical document that could impact businesses big and small. So, buckle up, because we’re about to explore the ins and outs of this whole shebang.

Why should you care? Well, if you’ve applied for a PPP loan or are thinking about doing so, understanding the warrant list is crucial. It’s not just about getting the money; it’s about making sure you’re compliant and avoiding any nasty surprises down the road. Trust me, no one wants to be caught off guard when the IRS or SBA comes knocking. Let’s make sure you’re prepared, savvy, and ready to take on whatever comes your way.

Read also:Movierulz 2025 Downloading Movies Securely And Efficiently Ndash A Comprehensive Guide

What is the PPP Loan Warrant List?

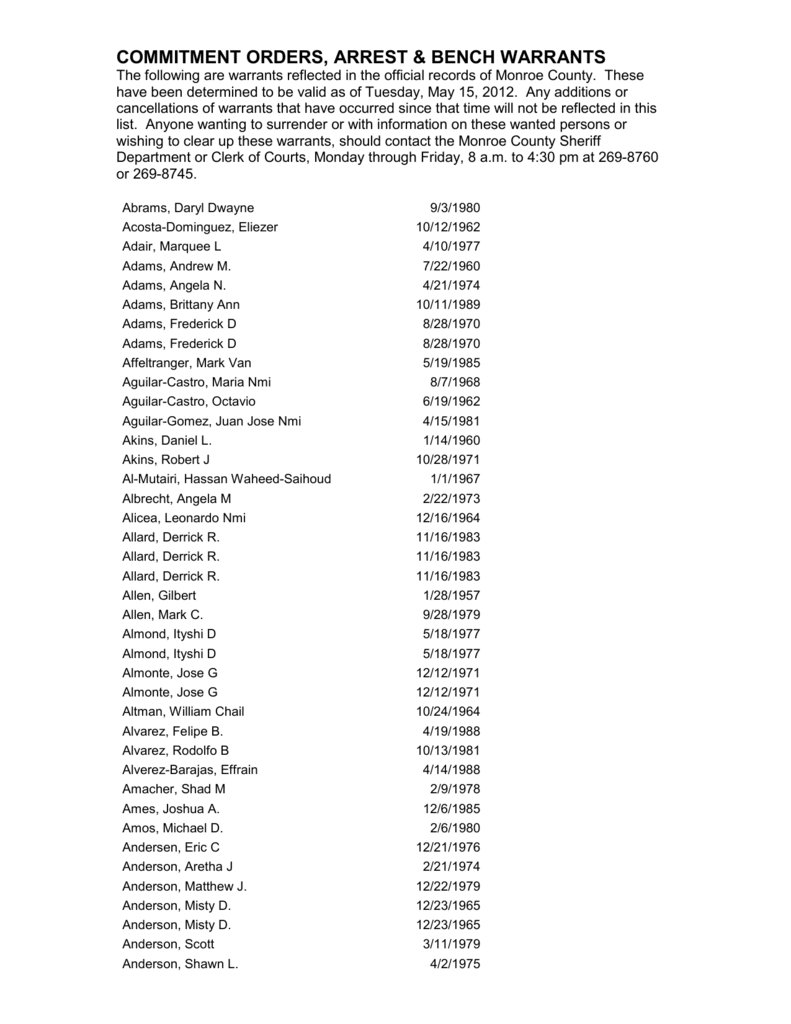

First things first, let’s tackle the big question: what exactly is the PPP loan warrant list? In simple terms, it’s a list of businesses that have received PPP loans and may be subject to additional scrutiny or audits. Think of it as a watchlist for the Small Business Administration (SBA) and other government agencies. If your business ends up on this list, it means they’re taking a closer look at your loan application and how you’ve used the funds.

But here’s the kicker: not every business that gets a PPP loan ends up on this list. The SBA uses a combination of factors to determine which loans are flagged, including the size of the loan, how the funds were used, and whether there were any red flags in the application process. So, if you’re wondering why your neighbor’s business isn’t on the list but yours is, it could be due to a whole bunch of variables.

Why Does the PPP Loan Warrant List Matter?

The warrant list isn’t just some random document—it has real implications for businesses. If your company is on the list, it means you could be facing audits, investigations, or even legal action if things don’t check out. This isn’t meant to scare you, but it’s important to understand the gravity of the situation. The SBA is cracking down on fraud and misuse of funds, and they’re using the warrant list as a tool to identify potential issues.

On the flip side, being on the list doesn’t automatically mean you’ve done anything wrong. It could simply mean that your loan application raised some eyebrows, and they want to double-check everything. That’s why it’s crucial to keep meticulous records and make sure you’ve followed all the rules and regulations. Knowledge is power, and the more you know about the warrant list, the better equipped you’ll be to handle any challenges that come your way.

How Does the PPP Loan Warrant List Work?

Now that we’ve got the basics down, let’s dive a little deeper into how the PPP loan warrant list actually works. The process starts with the SBA reviewing loan applications and identifying potential risks. If a loan is flagged, it gets added to the warrant list for further investigation. But how does the SBA decide which loans to flag? It’s not as simple as flipping a coin.

Here’s a quick rundown of the factors that might land your business on the warrant list:

Read also:Innovative Perspectives On Ga3d Nordart Art In The Digital Age

- Loan amount: Larger loans are more likely to be scrutinized because there’s more at stake.

- Fund usage: If the SBA suspects that funds weren’t used for eligible expenses, your loan could be flagged.

- Application accuracy: Any discrepancies or inaccuracies in your application could raise red flags.

- Business structure: Certain types of businesses, like those in high-risk industries, may be more likely to be audited.

It’s important to note that the SBA doesn’t make these decisions lightly. They have a team of experts and algorithms working behind the scenes to ensure that only loans with legitimate concerns are added to the warrant list. But that doesn’t mean you should take it lightly if your business ends up on the list. Being proactive is key to navigating this process successfully.

Who Oversees the PPP Loan Warrant List?

The PPP loan warrant list is overseen by the Small Business Administration (SBA), but they don’t work alone. They collaborate with other government agencies, like the Department of Justice and the IRS, to ensure that everything is above board. These agencies have the power to conduct audits, investigations, and even legal action if necessary.

But here’s the good news: the SBA also provides resources and support to help businesses comply with the rules and regulations. They offer guidance on how to use PPP funds correctly, how to document expenses, and how to prepare for potential audits. So, if you find yourself on the warrant list, don’t panic. Use the resources available to you and work with professionals to ensure everything is in order.

Common Misconceptions About the PPP Loan Warrant List

There’s a lot of misinformation floating around about the PPP loan warrant list, so let’s clear up some of the biggest misconceptions:

- Misconception #1: If your business is on the list, it means you’ve done something illegal. Not necessarily. The warrant list is just a tool for identifying potential issues. It doesn’t mean you’ve done anything wrong.

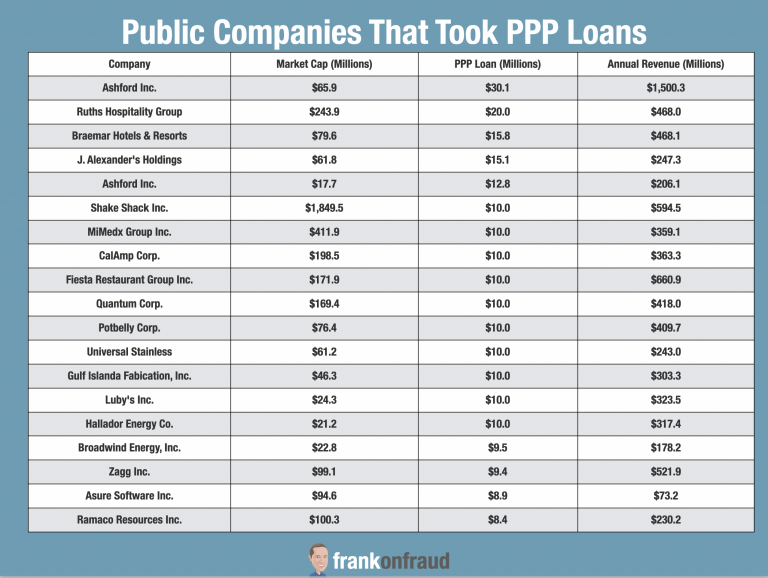

- Misconception #2: Only small businesses are affected. Actually, businesses of all sizes can end up on the warrant list. It all depends on the factors we discussed earlier.

- Misconception #3: Once you’re on the list, there’s nothing you can do. Wrong! You can work with the SBA and other agencies to resolve any issues and get your business back on track.

Understanding these misconceptions is key to avoiding unnecessary stress and panic. The warrant list isn’t the end of the world—it’s just a tool to ensure that PPP funds are being used correctly. So, stay calm, stay informed, and take action if needed.

How Can Businesses Avoid the PPP Loan Warrant List?

While there’s no foolproof way to guarantee your business won’t end up on the warrant list, there are steps you can take to minimize the risk:

- Follow all the rules and regulations when applying for a PPP loan.

- Keep detailed records of how you use the funds.

- Consult with professionals, like accountants or lawyers, to ensure compliance.

- Stay up-to-date with any changes to the PPP program or SBA guidelines.

Remember, the goal is to use the funds correctly and document everything thoroughly. If you do that, you’ll be in a much better position if your business ever ends up on the warrant list.

Understanding the PPP Loan Program

Before we dive deeper into the warrant list, let’s take a step back and talk about the PPP loan program itself. Launched in 2020 as part of the CARES Act, the PPP was designed to help small businesses stay afloat during the pandemic. The program provided forgivable loans to businesses that used the funds to cover payroll, rent, utilities, and other eligible expenses.

Here’s why the PPP was such a big deal: it wasn’t just a loan—it was a lifeline for millions of businesses. Without it, many companies would have been forced to shut down permanently. But like any government program, it wasn’t without its challenges. Fraud, misuse of funds, and administrative issues all came into play, which is why the SBA introduced the warrant list as a way to monitor and address these issues.

Key Features of the PPP Loan Program

Let’s break down some of the key features of the PPP loan program:

- Forgivable loans: PPP loans could be forgiven if businesses used the funds for eligible expenses and maintained their workforce.

- Eligibility: Businesses with 500 or fewer employees were eligible, although some exceptions applied.

- Fund usage: Funds had to be used for payroll, rent, utilities, and other approved expenses.

- Application process: Businesses had to apply through participating lenders and provide detailed information about their financial situation.

Understanding these features is crucial for anyone looking to apply for a PPP loan or navigate the warrant list process. The more you know, the better prepared you’ll be.

Impact of the PPP Loan Warrant List on Businesses

So, what happens if your business ends up on the PPP loan warrant list? The impact can vary depending on the situation, but here are some common scenarios:

- Audits: The SBA may conduct an audit of your loan application and financial records to ensure compliance.

- Investigations: If there are suspicions of fraud or misuse of funds, the Department of Justice may get involved.

- Legal action: In extreme cases, businesses may face legal action if they’re found to have intentionally misused PPP funds.

But here’s the thing: most businesses on the warrant list aren’t facing these extreme measures. Many simply need to provide additional documentation or clarify certain aspects of their loan application. The key is to stay calm, stay organized, and work with the appropriate agencies to resolve any issues.

How to Prepare for an Audit

If your business is on the warrant list and facing an audit, here’s what you need to do:

- Gather all your financial records and loan documentation.

- Review the SBA’s guidelines and ensure you’ve followed all the rules.

- Work with professionals, like accountants or lawyers, to help you navigate the process.

- Be proactive in addressing any concerns or questions the SBA may have.

Remember, audits aren’t meant to scare you—they’re meant to ensure that everything is in order. If you’ve done everything correctly, there’s no reason to worry. Just stay calm and organized, and you’ll be fine.

Resources for Businesses on the PPP Loan Warrant List

If your business ends up on the warrant list, don’t panic. There are plenty of resources available to help you navigate the process:

- SBA website: The SBA offers a wealth of information on their website, including guidance on PPP loans and the warrant list.

- Professional help: Consider working with accountants, lawyers, or consultants who specialize in PPP loans and SBA compliance.

- Support groups: Join online forums or local business groups to connect with others who are going through the same process.

Don’t hesitate to reach out for help if you need it. The more support you have, the better equipped you’ll be to handle any challenges that come your way.

Final Thoughts

Alright, folks, that’s the lowdown on the PPP loan warrant list. It’s not the easiest topic to wrap your head around, but with the right information and resources, you can navigate it successfully. Remember, the warrant list isn’t meant to punish businesses—it’s meant to ensure that PPP funds are being used correctly and that businesses are following the rules.

So, what’s the takeaway? Stay informed, stay organized, and don’t be afraid to ask for help if you need it. Whether you’re applying for a PPP loan or dealing with the warrant list, knowledge is your best ally. And if you’ve got any questions or comments, drop them below. Let’s keep the conversation going and help each other out.

Table of Contents